WHAT is a fintech? what are the different types of fintech found in french-speaking africa?

1.9 billion in 2022. The amount invested in fintechs in Africa. This represents 217 deals, or 31% of total deals (cf.

Partech Report – 2022 Africa Tech Venture

).

Fintech is the sector attracting the most investors in Africa. It remains, however, very difficult to grasp the regulatory subtleties. That’s why we’ve decided, in a series of articles, to look back at the definition of fintechs, the regulatory framework applicable to their launch, and to present the applicable regulatory regime.

In this first article we take a look at :

- definition of fintechs ;

- key players in the African fintech industry; and

- on the type of services that are quite regularly found in French-speaking Africa in the fintech sector.

What is a Fintech?

The term FinTech derives from the contraction of the words

“Finance” and “Technology”.

.

According to the Larousse dictionary, this invariable feminine noun designates “a start-up in the financial sector that uses new technologies to offer innovative, simpler and cheaper banking services and financial products”. The fintech sector refers to all these startups.

This expression therefore refers to technologies that aim to define innovative methods for delivering financial services.

By contrast, the FinTech sector broadly refers to all innovative companies, entities or “Start-ups” that use technology to rethink financial and banking services.

Who are the main players in Africa’s fintech industry?

Players operating in the FinTech industry are mainly grouped as follows:

- Approved banks who are investing in the full or partial digitization of their operations and financial products and services to formulate a fully digital offering. By way of illustration, TymeBank in South Africa, Orange bank in French-speaking Africa and Kuda in Nigeria are examples of digital banking on the African continent. (1).

- Financial technology companies or FinTechs that are not banks and offer innovative, less expensive ways of distributing technology-intensive financial products and services. Several FinTechs in French-speaking Africa operate in partnership with banking institutions or on an independent and authorized basis, mainly for the issuance and distribution of electronic money (Mobile money)(2).

- The GAFAM (3), i.e. Google, Apple, Facebook, Amazon and Microsoft, which have extended their initial fields of activity to include banking services such as payments, current account and credit card offerings. This trend was also observed in Asia at the level of the BATX for BAIDU, Alibaba, Tencent and Xiaomi in China.

What are the main services provided by FinTechs in French-speaking Africa?

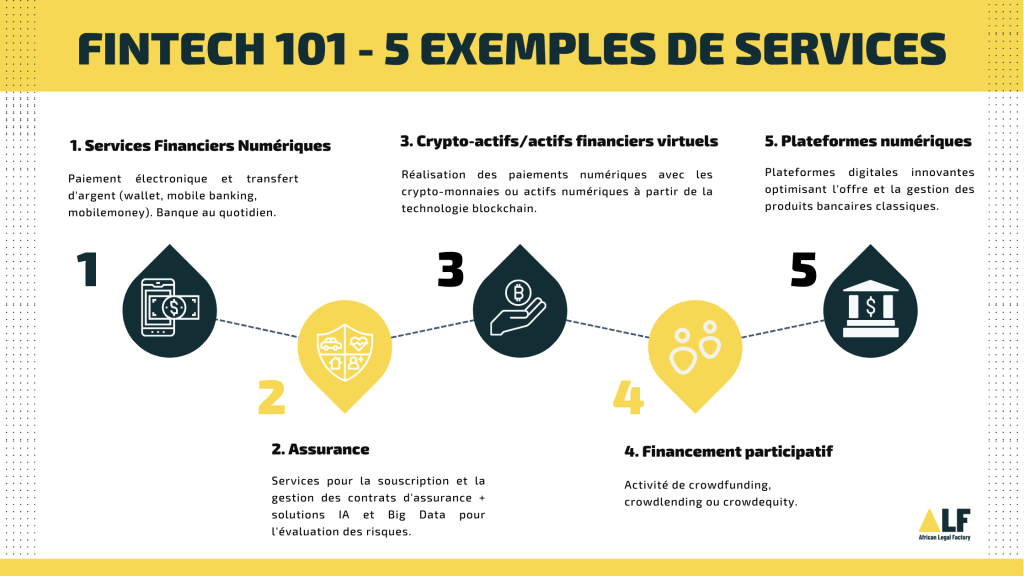

Financial technology companies or FinTechs offer the following types of services in French-speaking Africa (this list is not exhaustive):

- Digital Financial Services Electronic payment, electronic money issuance and distribution, money transfer, deposit, withdrawal, invoicing, small change management, savings, Wallet, Mobile Banking, Mobile Money, mass payment, merchant payment;

- Insurance FinTechs are also present in the insurance sector, providing services for underwriting and managing insurance contracts and claims. Players are also using artificial intelligence and Big data for risk assessment and predictive analytics;

- The creation and marketing of crypto-assets or virtual financial assets: crypto-currencies or digital assets are based on Blockchain technology through a computer protocol for the decentralized transmission and storage of encrypted information. They are used as virtual currencies for digital payments, although they have no clear legal status and are not recognized as financial instruments.

- Crowdfunding (credit and investment) This activity involves FinTechs collecting resources from the public via an Internet platform in the form of loans (Crowdlending), donations (Donation-based), or equity investments (Equity Crowdfunding);

- Development of digital platforms Digital platforms: these players have a strong presence in the segment of financial technology companies operating in French-speaking Africa, offering innovative digital platforms that optimize the offering and management of traditional banking products.

Finally, it’s worth highlighting the important role played by e-money issuance in the digital financial services ecosystem in French-speaking Africa. This positioning has been largely favored by efforts to formally regulate this activity, paving the way for digital transformation.

🔜 In order to launch your business as a fintech, it’s essential to know your status so you can understand the applicable regulations and potential prior authorizations. To find out what authorizations you need to obtain before setting up a fintech in West Africa, check out our upcoming articles.

Author information: this article was written by Kadder Ismaël TOURE, a specialist in participatory finance. The opinions expressed in this article are based on the author’s personal research.